🏦 Avoid Costly Surprises and Make a Smart Mortgage Choice 🏦

💡 Key Insights: Fixed vs. Adjustable—The Truth Behind ARM Loans

Adjustable-rate mortgages (ARMs) might sound appealing right now with lower initial rates, but is the short-term gain worth the long-term risk? In today’s changing market, understanding how ARMs work is more important than ever. If you’re thinking about financing a home, read this before choosing an ARM.

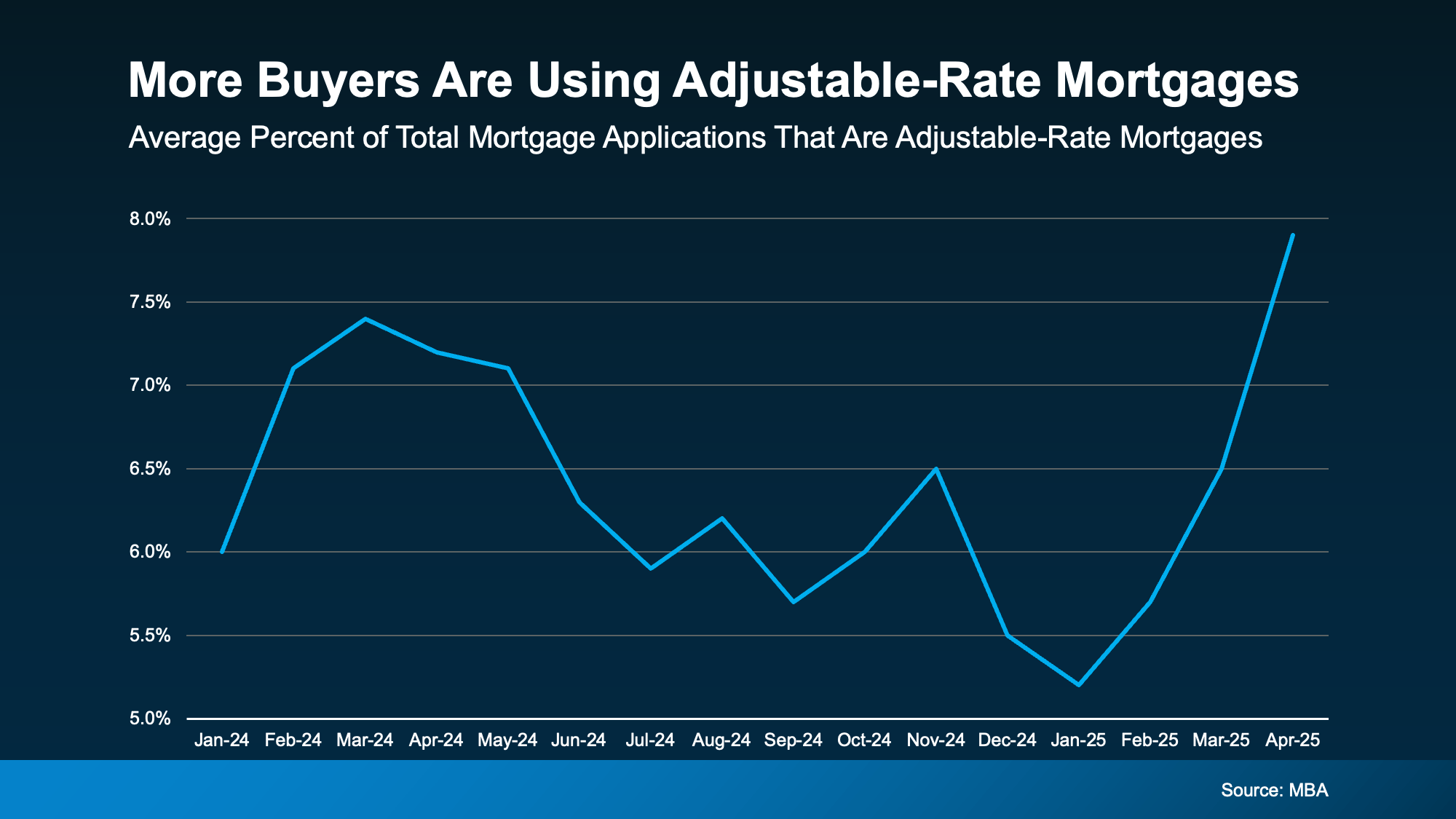

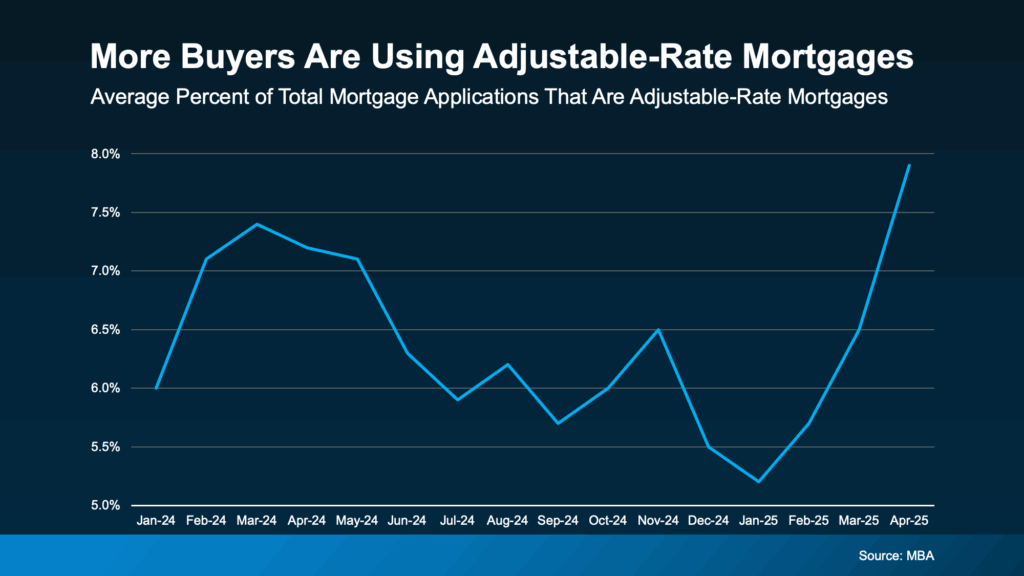

You can see the recent trend in this data from the Mortgage Bankers Association (MBA). More people are opting for ARMs right now (see graph below):

Source: Keeping Current Matters

🧠 Protect Your Wallet—Know the Truth Before Choosing an ARM

😟 Don’t Get Caught Off Guard: The Emotional Side of ARM Loans

Imagine this: you move into your dream home with a super-low rate, only to see your monthly payment jump hundreds of dollars in just a few years. That’s the risk with ARMs—rates are only fixed for a short period before adjusting, often upward. With inflation and future interest rate uncertainty, today’s low ARM rate could become tomorrow’s budget nightmare. Homeownership should bring peace of mind, not payment panic.

📣 Confused about mortgage options? Let’s talk before you sign anything.

I’ll connect you with trusted lenders who can help you understand what’s truly best for your financial future.

🔐 Learn the #1 Mortgage Mistake Buyers Regret—and How to Avoid It

🛠️ Step-by-Step: How to Choose the Right Mortgage for YOU

1. Understand the Basics:

- A Fixed-Rate Mortgage locks in your interest rate and monthly payment for the life of the loan.

- An Adjustable-Rate Mortgage (ARM) usually offers a lower initial rate but can adjust after 5, 7, or 10 years.

2. Think Long-Term:

- Are you planning to stay in the home long-term? If yes, a fixed-rate is likely safer.

- Only consider an ARM if you’re confident you’ll sell or refinance before the adjustment period.

3. Ask the Right Questions:

- What’s the maximum interest rate adjustment?

- How often will the rate change and by how much?

- What’s your financial backup plan if your payment increases?

🏡 Let’s Make Sure Your Mortgage Moves You Forward

Buying a home is a major life moment—make sure your financing supports your dreams, not your stress levels.

📞 Visit my website to the recommended lender section or Contact me today for lender recommendations, expert guidance, and smart strategy from start to close.

Let’s find you the right home and the right loan—safely and confidently.

back to blog home